It’s Your Money: Why Not Get Your Tax Withholding Right?

The IRS issued about 95 million federal income tax refunds by May 12, 2023 (for tax year 2022), averaging $2,812.1 You might consider this type of windfall a stroke of good fortune, but is it really? You probably wouldn’t pay someone $234 each month to receive $2,812 back at the end of a year. But that’s essentially what a tax refund is — the repayment of your interest-free loan to the government.

If you received a large refund on your 2022 return, consider reducing your federal income tax withholding, which would leave you with a bigger paycheck. Taking home more of your pay may let you put that money to better use. For example, you may be able to pay off credit-card debt sooner, build up your emergency savings, or contribute more to a retirement account. If your tax bill was higher than you expected and you had to scramble for the money to pay it, bumping up your withholding might help you avoid a similar situation next April.

In any case, it’s a good idea to check your withholding periodically. This is particularly important when something changes in your life; for example, if you move, get married, divorce, or have a child; you or your spouse change jobs; or your financial situation changes significantly. The IRS has an online tool (the Tax Withholding Estimator) that can help you determine whether — and how much — to adjust your withholding.

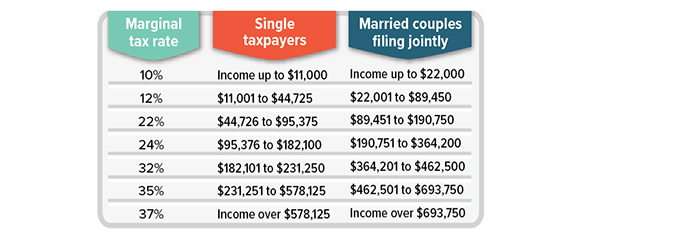

Federal Tax Brackets for 2023

The amount of federal income tax withheld from each paycheck is based on the information on your W-4 Form, which may have been filled out a long time ago. If you decide to make an adjustment, you will need to complete a new W-4 and submit it to your employer.